We were aiming to sell two properties to purchase our ‘dream’ family home.

The sale of our second property, a rental flat, fell through three weeks into lockdown. The tenant moved out in January 2020, so we were responsible for the mortgage and all the bills.

Fortunately, we managed to re-let the flat on June 19 and we won’t re-list the property until the market recovers.

We’ve also taken our main home off the market as we needed the funds from both sales to buy the house, we’d set our hearts on. We don’t think we’ll be able to move for at least 12 months.

We’re relieved that we’ve re-let the flat but we’re really disappointed that we’ve had to abandon our plans to purchase our dream home.

The uncertainty and the financial impact have been very stressful, especially at a time when my husband was furloughed, on 80% of his salary.

Why did the sale fall through?

We’re not clear why the sale fell through as most of the staff in the agency managing the sale were on furlough. We think it had something to do with the Title for the garage and parking space not being linked to the property by the developer when it was originally built. This caused a massive delay while we tried to get a ‘Deed of Variation’ completed.

This is still ongoing. While the management company have agreed that the garage and parking space is ours, it needs to be legally transferred to us, which we are in the process of completing, incurring further costs that we weren’t anticipating.

How good has communication been throughout the process?

We couldn’t get in touch with our agent, but we were lucky enough to have the contact details for the conveyancing panel managers.

They were amazing the whole way through. They kept us informed and they were very honest about what they could do and couldn’t do to help us.

Has it put you off moving again?

No, but we will ensure all the paperwork is in order this time. We’ve also decided that we won’t put our main home on the market until the apartment is sold and the money is in the bank.

We have spent about £6,500 trying to resolve the issue with the Title and covering the cost of the mortgage and bills associated with the rental apartment. We were lucky to have those saving in the first place.

What would have helped?

1. The issue with the Title should have been discovered and resolved when Charlotte originally purchased the apartment (or when it was originally built).

2. The sales particulars should have made reference to the flat being sold with a parking space and garage. Appointing a conveyancer and ordering searches as soon as the apartment was listed would have enabled a good conveyancer to swiftly identify the fact that there was a problem with the Title for the parking space and garage. This would have provided Charlotte with an early warning on the costs involved and it would have allowed extra time for the Title issue to be resolved.

3. Understanding the problem from the outset would have meant that potential buyers could have been told about the issue and told that completion may take a little longer. Remember, buyers don’t always want things faster, but they do need to know what to expect and why.

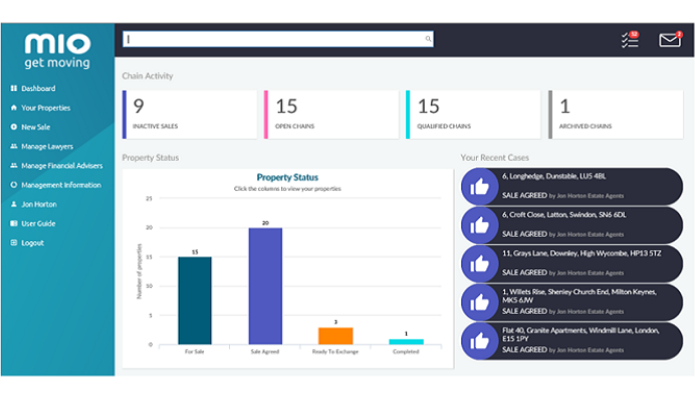

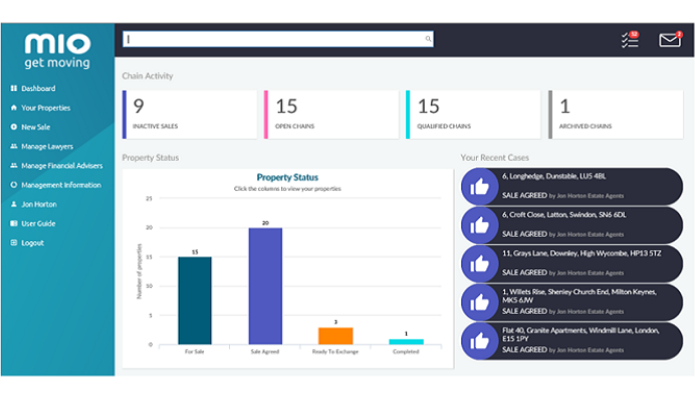

4. Staff within the agency managing Charlotte’s sale should have kept Charlotte and her buyers updated. The mio consumer app makes this really easy. If the person who was managing Charlotte’s sale was on furlough, one of the employees who was still working could have quickly understood the status of the transaction in mio and kept Charlotte and her buyer updated. mio would also have been automatically updated as the conveyancing process progressed.

These changes are not too difficult to deliver. Using mio, for example, is easy and it can be switched on for an estate agency branch, in a couple of hours.

A few simple changes could have resulted in at least three transactions completing which would have generated valuable income for the estate agents involved.

The estate agent and conveyancer would also now be able to celebrate and promote the completion of a challenging transaction that enabled Charlotte and her family to move into their dream home.

Contact us today to find out how mio can help you.

*Emma Vigus is managing director of sales progression tool mio

Join the conversation

Jump to latest comment and add your reply

What is the credit score range for TransUnion?

The credit score you see if you're signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780.

You can also get some professional help with Bad Credit Score from this team via WhatsApp.

WHATSAAP NUMBER : +1 914 274 8666

Please login to comment