Coadjute

Demystifying Distributed Ledger Technology – a network for the property market

04 November 2022 7035 Views

What’s the difference between Centralised Ledger Technology and Decentralised Ledger Technology?

Repeat after me; centralised and decentralised ledgers and Distributed Ledger Technology (DLT). No, it’s not a terrible attempt at a tongue twister, however were you to stop the next person you cross in the street and ask them to tell you the difference between centralised and decentralised ledgers, they may well struggle to give you an answer. How can we blame them? Where do you start when a Google search of “DLT explained' throws over a million results?

It’s something we can empathise with at Coadjute. Our very own solution for the property market is built on the R3 Corda Enterprise DLT, the very same technology used by banks and financial market infrastructure providers across the globe. But sometimes bridging that gap between an understanding of blockchain versus Distributed Ledger Technology is a tough one to navigate.

With this in mind, we wanted to help translate some of that vexing vocabulary associated with distributed ledger technology. After all, knowledge is power!

What is a ledger?

Before we jump in, let’s take it back to the very basics.

By its dictionary definition, a ledger is a book or other collection of accounts (often financial). It’s a place for record keeping, where all your financial transactions are documented. Whether you’re an individual or an organisation the principle is the same, the only difference perhaps being the size and scale.

For as long as there has been currency and trading, ledgers have been at the heart of economic transactions, to record contracts, trades, transfers of assets and property, to name a few. We’ve been doing this since ancient times, from chipping away at stone slabs to putting a pen to paper.

Technological advancements in the 70s and 80s ushered in a new era of possibility for ledger keeping, using computers to increase speed and convenience. This innovation meant the once simple, one-dimensional ledger could now take many different forms.

What is a centralised ledger?

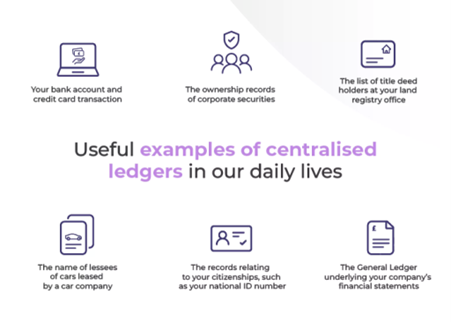

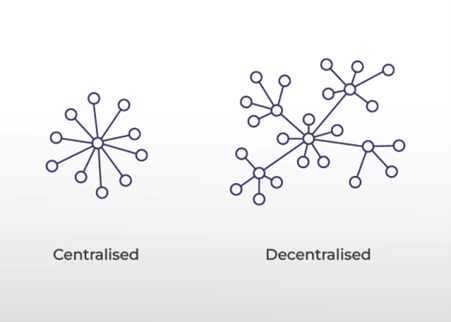

Centralised ledgers can actually be found everywhere in our daily interactions. A centralised ledger is controlled by a single party or entity in a closed-off environment, and the more power concentrated in a single party, the more centralised the ledger is.

You might be thinking this set-up sounds familiar, and you would be right, we are surrounded by them. From car number plates, to phone numbers, even your bank account - a central authority controls it. In the latter example of your bank account, your money, transactions, and all that associated information is held on the (centralised) ledger managed by the bank (the trusted third party). The bank owns the ledger of all the accounts it holds, maintains the ledger, registers every transaction and all this knowledge is owned by the bank in a closed-off environment. All you need to query the ledger is a unique identifier to find your information, in this example your bank account number. Considering the size and scale of some centralised ledgers, without this unique identifier information it would be impossible to pinpoint any information it held.

The systems of centralised ledgers have served us well so far. Within the closed-off environments in which they operate they are highly efficient at maintaining information. However, there are a few risks that exist. Given that centralised ledgers are singular in nature, they have a single point of failure, means they are vulnerable to outages taking the data offline, or access to the ledger can be limited or even withheld should the central party choose to do so.

What is a decentralised ledger?

While centralised ledgers have undeniable benefits, the very fact that information and data is held in one place means centralised ledgers have an inherent vulnerability, and are a single point of failure. So what would happen if we removed that centralised trusted entity from the equation? Or if we spread the power of controlling the ledger across multiple entities? This is where decentralised ledgers come into play.

The process of decentralisation removes the trusted third party from the situation, meaning there’s no longer one entity in control. The less power placed in a single entity, the more decentralised the system becomes. As a result, it opens up the ledger for everyone, not just to access and view the data but also open for everyone to record transactions. This is usually performed by something called nodes. Nodes are devices that play part in forming a larger network and each node holds an identical version of the transactions taking place on the network. So when a new transaction is recorded, it gets broadcast from node to node so that everyone one of them can update their own information in the same way.

You may have heard decentralised ledgers or networks also being referred to as distributed. That’s because these systems are also distributed in nature, that is, the nodes responsible for maintaining the database of past transactions are spread out geographically, across a region or even the globe.

This type of network is incredibly powerful, as it opens up new avenues of trade between businesses that wouldn’t usually trust each other, or would typically have to rely on and pay expensive fees to a third party that they both trust in order to manage transactions.

There are broadly two types of decentralised ledgers today:

Public Decentralised Ledgers

In the public decentralised model all transactions are publicly visible, and there is no central authority monitoring the ledger. Instead the public ledger is stored on the personal computer and devices or those individuals or businesses accessing the network. By donating to the collective, the need for a central authority ceases as everyone has access to the ledger (sound familiar?), an example of this would be the Ethereum public network. Furthermore, the ledger itself cannot be falsified. If one individual tampers with their ledger, the network will verify their ledger against the other ledgers owned by the rest of the community and will reject it.

Private Decentralised Ledgers

In the private (or enterprise) decentralised model, access to the network is typically controlled by a consortium of network operators. Participants can only join the network through invitation and are only approved to use the network following necessary identity checks being completed. In the enterprise example of private ledgers, having well-known and vetted parties is a critical element.

Now, this does not mean that the network is controlled by a consortium (centralised ledgers), only that certain housekeeping checks are applied before admitting anyone in. Every participant on the network still verifies every transaction independently to ensure that the rules of the business are being followed by everyone else, as they would in a public network. If there is any malicious behaviour by a participant, they can be reported and removed from the network by the operator. An example of this type of network is the Corda DLT platform.

If the Ethereum public network (Public-Decentralised) is the wild west, the Corda private network (Private-Decentralised) has sheriffs to ensure that all participants act in good faith.

What’s all this got to do with Coadjute?

The Coadjute Network utilises the Corda DLT platform, which is one of the leading enterprise DLT’s with financial grade security, to connect all the various systems and software applications used across the residential housing market.

As we know, the property transaction process is very fragmented and decentralised in nature, with many different parties being involved at any one time. Things move slowly, updates are not easy to come by, and the process is particularly cumbersome.

Anyone who joins the Coadjute Network has their own dedicated node, which is their gateway to connect and interact with other participants on the network. By connecting all the parties involved in a property transaction to a shared ledger (the Coadjute Network) all these distributed parties are brought together, reading from a single source of truth, and it opens the door to a more efficient way of completing property transactions.

If you would like to find out more about the Coadjute Network and see how we use Distributed Ledger Technology check out this video.

Amol Pednekar, Chief Engineer at Coadjute

This article was originally published on Coadjute.com