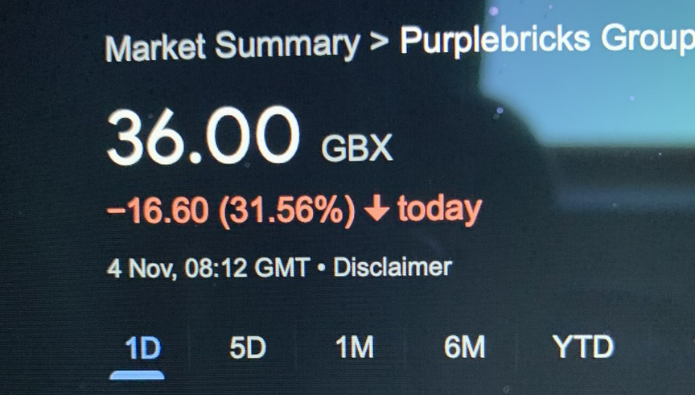

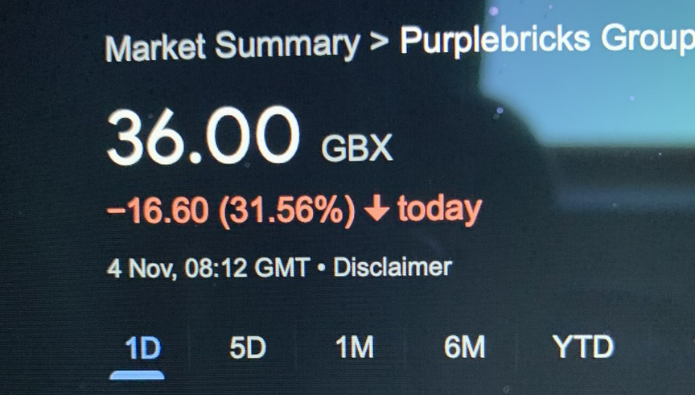

Purplebricks' share price tumbled a remarkable 34 per cent this morning when trading opened on the London Stock Exchange.

The price crashed from its Wednesday close of 52.6p to under 35p during the first hours of trading.

This share price drama followed this morning's downbeat trading statement warning of a series of problems hitting the firm - a slump in instructions, limited supply, a new pricing structure, and shifting self-employed workers on to full-time staff contracts.

What was not mentioned in the statement was the threat of legal action made against the agency by Contractors4Justice, who are seeking compensation for former self-employed workers who claim should have received holiday pay and other entitlements.

Instead, this morning's statement from Purplebricks majored on what appears to be a form of advance warning to shareholders ahead of its next scheduled trading update on December 14.

This morning's statement says:

After an exceptionally strong period for the UK housing market in FY2021, buoyed by the stamp duty holiday, the six-month period to 31 October 2021 has been more challenging. New instructions have slowed significantly in recent months, given continued strong demand across the housing market is not being met by sufficient supply of instructions. This imbalance has resulted in new instructions coming to market being approximately 23% below the comparative period last year.

Strategic transformation and momentum The Group has driven considerable transformation during the first half of the year and has significantly invested in and transformed its business model in this period, introducing new pricing and a simplified proposition alongside a new operating model. We are pleased with the progress we have made transitioning our sales team to a fully employed model, which will offer our agents greater security and benefits and will enable the Company to scale up quickly when market conditions improve. We have over 95 per cent of our new sales team in position and are starting to see encouraging progress across both conversion rates and ancillary attachment rates. We are also pleased with the progress we have made in enhancing our digital capabilities as we continue to transform the buying and selling experience for consumers.

Given the supply and demand imbalance in the market and the disruption caused by the business transformation, we expect to report a reduction in instructions for the six-month period to c. 22,000 (H1 2021: 35,387). Our cash position as at 31 October 2021 was approximately £58m (31 October 2020: £75.8m), which reflects a period of significant investment in digital, non-recurring costs incurred in managing the business through the pandemic and one-off exceptional costs in transitioning to a fully-employed model. We expect the cash position to stabilise in the second half of the year.

Outlook Going forward, uncertainty remains regarding the imbalance of supply and demand in the housing market and given the disruption caused by the business transformation, we expect this dynamic to continue into the second half of the financial year, impacting new instructions for the full year. The cost guidance provided with the Group's update on 10 August 2021 remains unchanged, and therefore adjusted EBITDA is expected to be below previous guidance.

However, we are confident that our transformed business model will partially mitigate the impact of market conditions on instruction levels. This transformation is yielding positive results in terms of growth in ARPI and we are starting to see progress in our market share aspirations and are well-positioned to grow following the completion of our transition to a fully employed model in the second half.

The Company's medium-term guidance remains unchanged, and the Board continues to expect Purplebricks to be able to deliver annual revenue growth in excess of 20% in the medium-term, with confidence in the Group's ability to deliver against its growth strategy.

Vic Darvey, CEO, commented: "Following a stronger period for instructions last year, supply in the market has fallen as we slowly adjust to a below normal level of activity following a period of successive lockdowns and the end of the stamp duty holiday. Our service proposition remains strong and compelling, with properties selling quickly, but the reduced amount of stock coming to the market is proving challenging.

"Against this more challenging backdrop, the team is continuing to execute on our transition to the new operating model. We are encouraged by the early results we are seeing on the ground and whilst they are not yet reflected in the overall group performance, we are confident in the strategy and that we have developed a strong platform for growth as activity levels pick-up. We are committed to our mission of achieving 10% market share by being the go-to-place to buy, sell or let your home."

%20-%20IMAGE%20Client%20Accounting%20%E2%80%93%20what%20are%20your%20options.jpg)

.png)

.png)

.png)

%20(002).png)

%20(002).jpg)

Join the conversation

Jump to latest comment and add your reply

The honeymoon period known as the stamp duty holiday is over. These Purple people will now have to put some effort in to sell homes. They are just a listing service and complaints from sellers will multiply now. The investors have taken a punt in this flawed approach to selling houses. I give them two years before they are history and that is not quick enough.

They can always sell it back to the Bruces!!!

Beginning of the end for PB, I think. All seems to be going in one direction, no matter how much money they chuck at it. I've always pointed to PB's excellent brand awareness - which is undeniable - as one reason why they might survive in a way that YOPA and easyProperty and other online operations clearly aren't, but clearly that only gets you so far if it's not backed up by actual results.

I still know of quite a few people who would be willing to give PB a go because real agents 'do nothing', but of course the reality is a lot different. And now that PB have lost their USP, they're just another failing brand which gets caught up in more PR own goals than most.

I have so many things to say and all of them are entirely obvious….

Writing on the wall now (hopefully!)

Please login to comment