A report from Countrywide says the proportion of homes in Great Britain bought with cash fell to a mere 28 per cent in the first six months of this year - the lowest level since records began in 2007.

The data, from Countrywide’s upmarket Hamptons International brand, says the this 28 per cent figure is significantly lower than the peak of 36 per cent recorded in 2009, while the credit crunch was gaining momentum.

Every region in Great Britain recorded a fall in cash sales over the last two years.

The West Midlands recorded the biggest decrease in the proportion of homes bought with cash since the first half of 2017 down 9.0 per cent in that period.

This was followed by London (down 7.0 per cent).

Scotland recorded the smallest fall, with the proportion of homes bought mortgage free decreasing just 1.0 per cent over the past two years.

The South West - a key area for retirees and downsizers to purchase - remains the region with the highest proportion of cash sales; 34 per cent of homes were purchased with cash in the first half of this year.

Meanwhile London had the lowest proportion of cash sales – just 19 per cent.

According to the latest Land Registry data the average home bought with cash in the January-to-June 2019 period cost £217,810; in London this figure is £489,820.

Hamptons says that 10 years ago investors accounted for 32 per cent of cash buyers, but during the first half of 2019 only 24 per cent of cash purchases were bought as a buy-to-let.

Those buyers who did purchase in cash bought smaller homes too.

Some 18 per cent of cash buyers purchased a four-bedroom home two years ago but this fell to 16 per cent this year; two bedroom cash purchases rose slightly in the same period.

“The fall in cash purchases not only reflects tighter affordability, but also a decrease in activity amongst downsizers, the group of people most likely to have built up enough equity to purchase property with cash. It also reflects a drop off in the number of homes bought by investors, many of whom used cash to purchase” according to Aneisha Beveridge, head of research at Hamptons International.

Table 1 – Proportion of homes bought with cash by region

|

|

% of cash buyers

(H1 2019)

|

Change in proportion of cash purchases since H1 2017

|

Average cash purchase price (H1 2019)

|

|

South West

|

34%

|

-6%

|

£250,830

|

|

Wales

|

32%

|

-6%

|

£156,240

|

|

North East

|

31%

|

-5%

|

£116,610

|

|

Scotland

|

30%

|

-1%

|

£138,090

|

|

North West

|

29%

|

-5%

|

£149,890

|

|

Yorkshire & the Humber

|

29%

|

-6%

|

£155,310

|

|

East Midlands

|

27%

|

-6%

|

£185,200

|

|

South East

|

27%

|

-6%

|

£306,380

|

|

East of England

|

26%

|

-6%

|

£274,860

|

|

West Midlands

|

23%

|

-9%

|

£172,050

|

|

London

|

19%

|

-7%

|

£489,820

|

|

Great Britain

|

28%

|

-5%

|

£217,810

|

Table 2 – Top 10 cash buyer hotspots by local authority

|

Local Authority

|

Region

|

% of homes bought with cash (H1 2019)

|

Change in proportion of cash purchases since H1 2017

|

Average cash price

|

|

West Somerset

|

South West

|

58%

|

-7%

|

£231,890

|

|

Ceredigion

|

Wales

|

57%

|

4%

|

£191,430

|

|

Torridge

|

South West

|

53%

|

0%

|

£241,160

|

|

West Dorset

|

South West

|

53%

|

-8%

|

£289,290

|

|

Kensington & Chelsea

|

London

|

53%

|

-3%

|

£1,261,080

|

|

North Norfolk

|

East

|

53%

|

-7%

|

£260,240

|

|

Conwy

|

Wales

|

52%

|

2%

|

£164,440

|

|

East Lindsey

|

East Midlands

|

52%

|

-8%

|

£178,090

|

|

Isle of Wight

|

South East

|

52%

|

-4%

|

£223,950

|

|

Argyll and Bute

|

Scotland

|

51%

|

-1%

|

£140,970

|

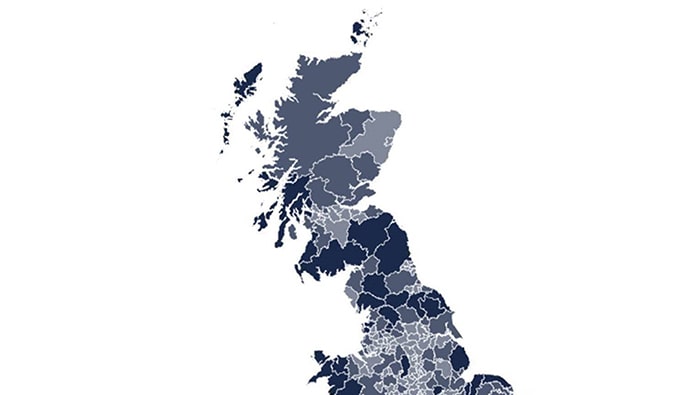

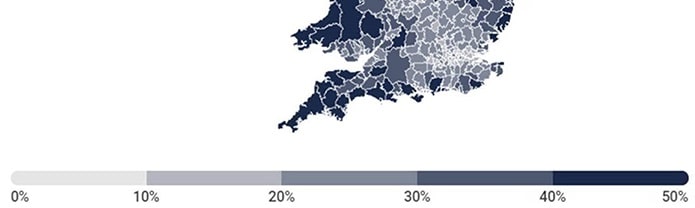

Map – Proportion of homes bought with cash by local authority (H1 2019)

Join the conversation

Be the first to comment (please use the comment box below)

Please login to comment