Jefferies - the City consultancy which has in the past worked with Countrywide - has cuts its forecasts for the troubled agency group’s performance in 2018 and 2019.

Following the release of Countrywide’s 2017 figures yesterday, and warnings given by its executive chairman, Jefferies’ equity analysts Anthony Codling and Sam Cullen have issued a note to investors saying that the agency’s group current management is “righting the wrongs” of the past.

Jefferies says Countrywide has had the same banking syndicate of six banks since its IPO back in 2013, and that this syndicate has now amended the terms attached to the banks’ lending in order to give the company greater flexibility.

“We are in no doubt that they completed detailed scenario analysis and we expect that their own credit committees asked them to complete even more extreme analysis before the new terms were agreed” says Codling and Cullen, who ask investors to bear this in mind when assessing Countrywide’s past, current or future performance.

The pair then say that while Countrywide’s 2017 figures were in line with expectations “we are however cutting our FY18 and FY19 EBITDA estimates by 24 and 22 per cent respectively, as the 'fixing up' is done, but in so doing give scant regard to operational gearing or self help.”

EBITDA is Earnings Before Interest, Taxes, Depreciation and Amortization, a common measure of listed companies’ performance.

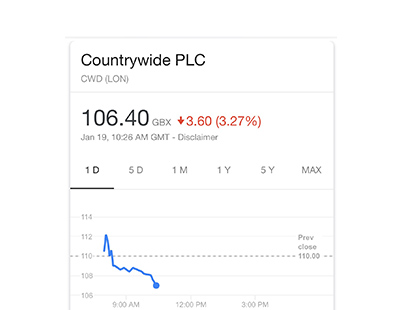

Meanwhile Countrywide’s candid admission about the scale of its market share loss and its blueprint for clawing back business appear to have left shareholders cold - the company’s share price closed yesterday down about 1.5 per cent.

Shortly after the release of its 2017 figures yesterday morning - and an interview with Estate Agent Today when Countrywide executive chairman Peter Long admitted the firm had been “grossly mismanaged” - the company’s share price plunged 20 per cent, although it recovered most of that lost ground.

Pre-tax profits more than halved to £25.2m, from £52.7m in 2016 and in across sales and lettings in London, earnings fell 44 per cent to £11.5m. The company is cutting head office jobs to 300 from 450 in a bid to reduce costs as part of its latest restructuring following the departure of former chief executive Alison Platt.

Long admitted that the patience of investors had been "sorely tested" and that shareholders would not receive a dividend.

Join the conversation

Jump to latest comment and add your reply

The big issue surely is the people now running the show are the very people who presided over the catastrophe in the first place.What happened to Platts severance ?

Please login to comment