Stamp duty relief for first time buyers of full-priced houses and apartments is to be extended to first time buyers of shared ownership properties - but this was one of few housing measures in today's Budget.

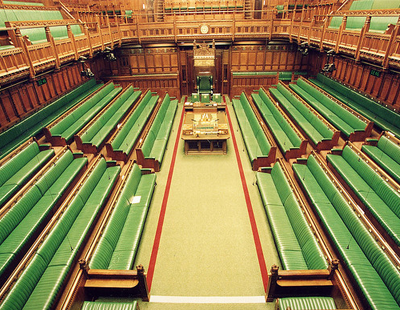

Addressing the Commons, Chancellor Phillip Hammond said first time buyer numbers were now at an 11-year high thanks to the stamp duty relief on mainstream homes announced last year - therefore he would extend this relief to first time buyers of shared ownership homes, applied retrospectively to late last year and applying to properties costing up to £500,000.

The Chancellor also confirmed previous announcements that the government was spending £44 billion on housebuilding and the stamp duty relief; there will also be a new strategic partnership for social housing with nine housing associations; there will also be a £1 billion boost in the form of Business Bank guarantees for small and medium sized housebuilders.

Although no reference to Help To Buy was made during the speech, a statement afterwards by the Home Builders Federation suggested that it would be extended to run until 2023 for first time buyers only. In addition - and again after the speech - it was revealed that the stamp duty surcharge for overseas buyers would be the subject of a consultation being launched in the New Year; the surcharge would be one per cent.

In his speech, Hammond told MPs that he wanted to ensure the private homes were kept out of the Capital Gains Tax regime; however, he did want to bring yet another rental activity into the tax net. So he announced that from April 2020 there will be limited tax relief on properties where the owner is in shared occupancy with the tenant - so for example, the current Rent A Room allowance and the increased letting of individual rooms through Airbnb and similar platforms. No further details were given during the speech.

Many small agency businesses may also be able to benefit from a two-year cut in business rates for the smallest shops - these will enjoy a one-third cut in rates.

There were relatively few other references to anything even loosely connected to the housing market in the Budget. But other measures included in the Chancellor’s speech this afternoon include:

- The creation of a digital services tax to be paid by companies with £500m or more in UK revenues, to be launched from April 2020;

- Rateable values of commercial properties to be adjusted in 2021 and smaller shops to enjoy a one-third cut in business rates for the next two years;

- Universal Credit to stay but with additional funding for implementation and different thresholds for recipients;

- More spending for NHS, particularly for mental health; more spending, too, for the MoD to boost (amongst other things) cyber capabilities; more spending for counter-terrorism police; funds to local councils for social care;

- One-off capital payments to schools for use within this financial year;

- The public-private Private Finance Initiatives abolished for future contracts;

- There will be another Budget next spring if there is what Hammond calls “a disorderly Brexit” - in the Autumn Budget last year he set aside £1.5 billion for Brexit preparation, and that has today been increased to £2 billion;

- "A Budget that shows the perseverance of the British people finally paying off… A Budget for hard working families… …who live their lives far from this place… …and care little for the twists and turns of Westminster politics”.

Join the conversation

Be the first to comment (please use the comment box below)

Please login to comment