One of the top questions on the mind of consumers at present is ‘what will happen to house prices as a result of COVID-19 and the lockdown?’

The short answer is that it is too early to tell. The housing market has effectively gone into suspended animation and there is little if any new pricing information available. While some have suggested house prices will fall five or 10 per cent in 2020, it isn’t possible to know what the economic impact will be.

Housing market activity levels hit more than prices

The impact of COVID-19 is hitting housing market activity more so than prices. Our own data shows buyer demand, or demand from sales 'applicants', has dropped 70 per cent since March 7 2020, the date when concerns over the virus really started to impact consumer activity.

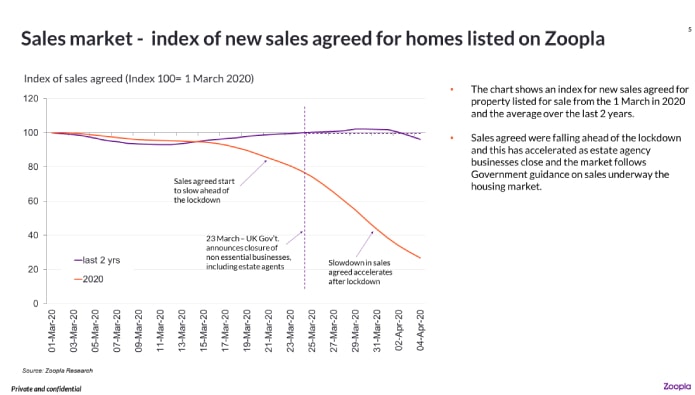

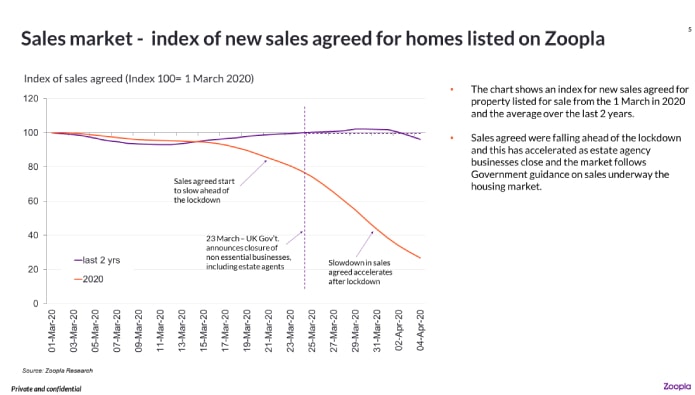

The impact on sales agreed and new listings coming to the market was slightly delayed. This really started to kick in as the government shutdown started to bite from March 24, and estate agents closed for business. The chart below shows sales agreed for Zoopla listings since March 1 compared to the average for the last two years.

We are not going to 'zero sales', some transactions will still happen, but in the coming months we are likely to see levels of completed sales transactions down 75 to 80 per cent compared to the levels recorded last year. Overall, we expect housing sales to be around half the levels last year at around 600,000. This will hit agents' revenue not just into Q2 2020 but also into Q3 (July-September).

Price signals comes from completed sales

House prices are a function of agreed sales prices and completed transactions. The value of a property is what a willing buyer and a willing seller agree as the price for a property after a reasonable marketing period.

Under normal market conditions, there is a three to six month gap between a home coming to the market for sale on Zoopla, then being marked as sold ‘subject to contract’ and finally making it through the valuation and legal process to a completed sale.

Fewer sales agreed and housing completions means the amount of information on which to inform the price of a home has declined rapidly. It is going to be harder for published house price indices to accurately track price changes in the months ahead as a result of fewer data points and more volatile pricing for agreed sales.

What about 2020?

Record-low mortgage rates, mortgage payment holidays and Government support for business means that we are unlikely to see a big increase in forced sellers (who would have to accept lower prices) in the near term. As such, we do not expect any big movement in house prices while the lockdown lasts. Beyond that, it depends upon how long the market remains disrupted and any longer-lasting economic impact.

In previous years, when levels of housing activity have fallen, but the economy has continued to grow, we have seen the rate of house price growth slow, rather than turn negative. Housing sales volumes fell in 5 of the 10 years between 1998 and 2007 but annual house price growth remained positive

What is the current outlook for house prices?

This latest shock to the market is unprecedented.

Only once the lockdown is lifted will we start to get any sense of the impact on pricing. Most important will be how much 'applicant' demand starts to return to the market, how quickly sales agreed start to rise and how the pricing of new property listed for sale compares to earlier in the year. These will tell us how the ending of a suspension of market activity is starting to impact prices.

Our current expectation is that the Government measures support business and that pricing levels will largely pick up from where they left off at the start of March. Buyers who dropped out of deals or new buyers coming into the market will be cautious and try to negotiate harder on the discount to asking price to achieve a sale. Our own data shows the current gap is around two per cent which is relatively small meaning there is some slack to absorb any price sensitivity.

Levels of house price growth are already low by long run standards (two per cent in 2019) so any prolonged downward pressure on prices, even modest, could push annual growth into single digit negative territory - this may be more a function of far fewer sales price points and more price volatility than short term falls in demand.

Huge housing equity buffer to absorb any price falls

One piece of positive news is that there is a huge amount of so-called 'housing equity' to absorb the impact of any house price falls. While there are £1,100 billion of outstanding mortgages in the UK, the total value of all UK homes, according to the Hometrack valuation model which powers our Zoopla home valuations, is more than five times higher. This is a large cushion to absorb any decline in prices.

Tougher mortgage regulations mean most people taking new mortgages in recent years have put in 15 per cent-plus deposits, so the likelihood of negative equity is low even if prices were to post larger than expected falls.

We will be keeping a close eye on the data so will keep you posted as the market situation evolves.

%20-%20IMAGE%20Client%20Accounting%20%E2%80%93%20what%20are%20your%20options.jpg)

.png)

.png)

.png)

%20(002).png)

%20(002).jpg)

Join the conversation

Jump to latest comment and add your reply

I think it’s likely that buyer activity will restart stronger than seller activity post lockdown. Depending on mortgage availability this will either stop prices falling or lead to mini boom as people take a deep breath and realise they only live once

We see this as a pause in the market not a drop or crash. Interest rates will stay low so once we are through this situation, owning a home will be the most affordable, for borrowers, it has ever been. Mortgages are only restricted at the moment as lenders don’t have the staff in place to process them. We just don’t need the media or industry “experts” to talk us into a recession.

The last few years have seen a comparable number of sales each year at around 1.1m whilst the number of agents increased to over 21,000 with no barrier/regulation to entry.

That will change this year dramatically, somewhere around 50%-60% if we are lucky which will see a dramatic decline in agents.

We are now just over 17,000 agents listed in the UK, i see that falling to sub 15,000 as the will see now sales revenue until October.

This coupled with the following;

- time to completion up to 19 weeks last year

- no one taking summer holiday break this year due to our current lockdown might see an earlier peak

- a rush to the market putting more strain on the legal & banking sectors to process more transactions quicker

- lack of surveyors

- back log of removal companies and other related services needed to complete

What ever way we look at this, once we 'start' again, there will be a bottle neck to most transactions.

Completions - however you look at it, sadly will be hit for 2020. If you are an optimist there will be a bounce post Covid, if you are not it will be flat or dip. But stock levels at present across the nation's agents are low, the usual pre-spring level, that would have dramatically swelled during the peak listing and selling period, late March to early June.

With lockdown until 6th May earliest and probably running into later May, even if agents re-opened in early June it would take 6 weeks of 'normal' agency for stock levels to rise to a level where volume sales could happen, so mid July. Give sales take 5 months to complete, that will push many into 2021 as a completion timescale.

So, I am thinking completions at 65% level of the usual 1m to 1.2m level, at best maybe lower, which of course means a proportionate loss of completions monies flowing in this year. I am not being pessimistic, just analysing the figures. A really sad thing, three years of Brexit - thank you politicians for hampering all of the economy while you squabbled and now this pandemic.

Please login to comment